National Institute on Retirement Security (NIRS) research finds “retirement savings are dangerously low, and the U.S. retirement savings deficit is between $6.8 and 14.0 trillion.” While the US population overall is not saving enough and many will struggle financially in retirement, there is a small group of super savers, like you, who might be saving too much, and as a result also puts you at risk but in an entirely different way. Am I saving too much for retirement? is a question that comes up from time to time with clients and I will address here.

Let’s face some hard undeniable facts, we only get one chance at this thing called life; no one knows for certain how long they’re going to live, and you can’t take assets with you. So, we had better make it a good one by enjoying life (responsibly) while we have the ability and time to do so. Most people will probably resonate with the sentiment that “no one wants to be the richest person in the cemetery”. Therefore, most people’s goal should be to balance their needs and wants of today with their needs and wants of the future – and strive to have enough but not too much money left at the end.

Am I saving too much for retirement?

Let’s start out with who this article is written for. FlightPath Financial Planning focuses on guiding early to mid-career professionals, pilots, self-employed and small business owners to financial independence. We give advice on how to save, invest, and spend – to live life to its fullest, while not putting your financial future in jeopardy. By helping you make better financial decisions, we can give you the confidence and freedom to live your best life.

While everyone’s financial plan is going to be a bit different, here are some clues as to whether you could be over-contributing to retirement and might be able to reduce your retirement savings, allowing you to enjoy life more fully today.

- You are expecting a large inheritance. If you come from a well to do family that has pledged a large inheritance or has set up trusts that you know you are the beneficiary of.

- You have already saved a lot (keeping in mind if you’re married your spouse also needs to have saved that much proportionate to their income). If you are approaching

- 30 and have already saved more than 1x your salary

- By age 40 3x your salary

- By age 50 6x your salary

- By age 60 8x your salary

- By age 67 10x your salary

- You already own your house and have substantial equity in it

- You are in your early 20’s and have already started saving for retirement

- You love what you do and don’t think you will ever want to retire

- You live frugally and will remain frugal in retirement

- You do not have kids, or do not wish to leave them or anyone else a large inheritance

- You have been diagnosed with a VA disability and will receive disability income for life

- Your employer provides a well-funded pension plan

If any of the above applies to your situation, you might be saving too much for retirement.

What percentage of my income should I save for retirement and how much should I put in my savings every paycheck?

There are a few different metrics you can use to determine the right amount to save. The 50/30/20 budget rule is a budgeting method that can help you visualize how your money should be allocated to manage more effectively; it is rather simple to implement, although it can be rather difficult and time consuming to keep track of.

The rule suggests the following:

- 30% of your budget should go to wants, such as: dining out, clothes shopping, holidays, gym memberships, entertainment, and travel.

- 50% should go to needs such as: monthly rent or mortgage, utility bills, transportation, insurances, minimum loan repayments and basic groceries.

- 20% should go to savings such as: retirement, an emergency fund, short- and long-term goals and high interest debt repayment.

I don’t love rules. This is partly because my inner wild child doesn’t like to be told how I should do something. The other part is because rules can be rigid and often difficult to interpret the grey areas; does an item fall in this category or another category. So that is why I prefer to set up guidelines instead of rules. You have 100% of your income to allocate to something. For example, clothing, I would say everyday clothing is a need, but finer clothing like expensive shoes or an expensive leather jacket would be more of a want than a need. A gym membership or personal trainer to some is a need; fitness might be seen as a top priority to them because it makes them feel more confident and leads to a healthier overall lifestyle. For the rest of us a gym membership is probably a want, as there are likely cheaper alternatives available. Another example might be a sports activity like golf. To some, golf is where big deals are made and might be a business expense, to others it’s a part of their workout; but I’d say for most it’s just good fun and quality time out of the house, putting it in the want category. Because of these reasons, in my practice, I try to avoid grey areas that rules present as much as possible – and why I find providing guidelines to be more helpful. Then if the client has a hard time staying within those guidelines, we work on strategies to get them more dialed in.

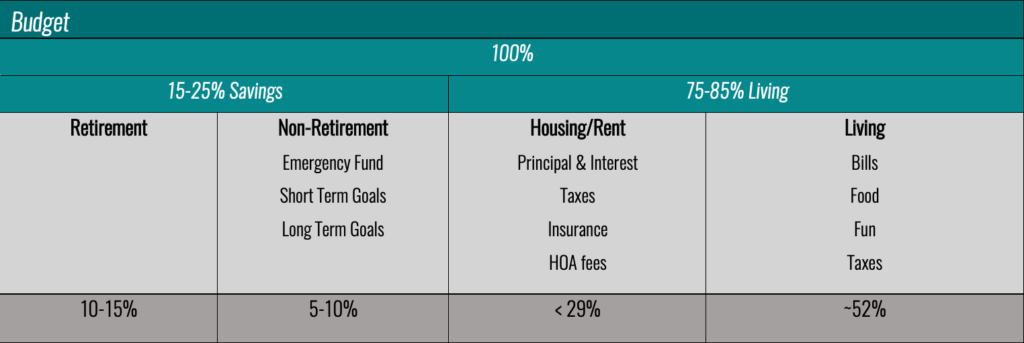

For an average client, this is how I like to break things down to ensure the client isn’t saving too much money and limiting their ability to enjoy their lives while they are young. For someone in their early to mid 20’s to early 30’s with 35+ years left in the workforce, I would start with a total savings rate of approximately 15-20% of their gross income. And unless there is substantial high interest debt that needs to be addressed first, 10% -15% should be going to retirement, and 5-10% should go to non-retirement savings. For someone with a lot of high interest debt (with greater than ~4% interest rate) there are some additional measures to take to minimize the total interest cost – which I will go into in another blog post. The rest of your budget which is 75% – 85% of your gross income can now be allocated to your housing and living expenses. By setting up recurring monthly contributions to come out of your bank or your paycheck regularly, you have prioritized the items that are most important and can now enjoy living on the rest.

Saving too much and not enjoying life

While super-spenders risk outliving their money, super-savers run the risk of their assets outliving them. Money that could have been spent earlier to accomplish life goals or to enjoy, unfortunately goes underutilized. That month-long trip to Europe you wanted to take in your 30’s, but didn’t because you thought it was too expensive, well it turns out it would have been affordable. Working extra-long hours with the hope of retiring early to spend more time with loved ones, in hindsight, doesn’t make a lot of sense if you end up dying with a glut of money in the bank. Or perhaps forever putting off buying your dream car because you thought it was too expensive or impractical. With the aid of a financial advisor and the robust financial forecasting tools at our disposal, you will be able to see the financial impact decisions have, giving you the affirmation or permission, you may need to pull the trigger on enjoying more life experiences. It has been proven, experiences – not things, make us happiest. Whether those experiences are firsthand like flying a helicopter over the Nepali Coast and into a Volcano in Hawaii, or second hand like the enjoyment received by a grandparent or family member gifting the down payment for a home for their adult children to raise their own family. As the grandparent you will get the enjoyment of watching your kids make their own memories and experiences. You do not regret the things you do in life; you regret things you don’t do. The person that ends their life full of experiences takes with them something that money can’t buy. Financial planning rewards those that recognize its value with the ability to maximize their life and their experiences.

How much saving for retirement is too much?

I have an out-of-the-box goal for my clients. Plan for the last check you write in life to bounce. I don’t mean this to mean stiff the last guy you pay. I mean, plan your life in a way that you have accomplished your goals by the time you die. Those goals should include experiences like, travel, adventure, hobbies, food, volunteering, giving, or whatever brings you joy.

I have a client who, unknowingly to them at the time, was on their way to saving far more money than they ever needed for retirement. In the meantime, they were working long hours in a high stress position. From a financial planner’s perspective, it was all for nothing. If your goal in life is to live life to the fullest and to enjoy the fruits of your hard work, then saving any more than you need to achieve your goals is a waste. When I came to them with my projections, based on the goals they had, their immediate reaction was, they wanted to cut back their hours. I was thrilled to have been able to give them the peace of mind that they were exceeding the savings required to meet their ideal financial lives, in turn this information gave them the peace of mind to cut back on work and enjoy the extra time with each other and their kids.

By planning to bounce the last check on the day you die, it would mean you had precisely determined your lifetime financial needs. While saving the precise amount would be highly unlikely, we are able to use statistics to give us meaningful data about the likelihood of ending our lives with significant wealth, or worse not enough, and avoid regrets of the bucket list items we didn’t get to do.

You might be thinking, what sort of tools do financial advisors use to see into the future? The most widely used method is a Monte Carlo simulation. A Monte Carlo simulation is a model used to predict the probability of a variety of outcomes when the potential for random variables is present. Monte Carlo simulation’s help to explain the impact of risk and uncertainty in prediction and forecasting models. Said simpler, we play out your financial situation in a computer simulation 10,000 different times each using different variables to see how likely your plan is to be successful. We input the parameters; the software outputs a probability. Our aim is to get you working towards an 85-95% probability of success. You might be wondering, why not 100%? Well 100% would mean you died with excess money in your pocket, money that was underutilized by you and your loved ones.

To answer the question of how much saving for retirement is too much, and how do you balance savings and enjoying life? At FlightPath Financial Planning, we believe most people should desire to maximize their wealth through life experiences. Too much savings would, from a financial planner’s perspective, be any saving amount that would give you a very high to almost certain confidence of dying with a lot of money left over, and be wasted. As to how to balance savings and enjoying your life? We strongly believe working with a financial planner early in your career will not only save you money, it will give your money more time to grow, reduce the total amount you have to save, and allow you to invest more freely in life experiences. Due to the complex nature of financial planning, how much is too much can only be reliably determined through thorough analysis by a Certified Financial Planner Professional®. Working with a professional planner will help you to balance your savings and boost your confidence in your financial plan. In return, we believe you will achieve much greater satisfaction with your life, because you are living your ideal life.

To start living your ideal life and avoid regretting the things you didn’t get to do, schedule a meeting with one of our Certified Financial Planners at FlightPath Financial Planning today.