In wake of the pandemic, the home buying landscape has changed dramatically, and regardless of where you reside, it has become much less affordable in recent months. But that doesn’t mean it is completely out of reach, just that you should be aware of the risks and discuss with a financial planner whether this is the right time for you to buy a home. Buying a home is a huge decision that requires a lot of thought and consideration. It’s not something that should be taken lightly, as it can have a significant impact on your financial future. There are many factors that you should consider when determining whether you can afford a new home and should buy or not. In Part 1: of this blog article, we will discuss some of the key factors that you should consider when answering the question, “Is this the right time for you to buy?” In Part 2: we will discuss getting finances in order to buy a house, including things like how to qualify for buying a house, income requirements for buying a house and other important financial considerations.

Understanding Your Motivations to Buy a House in the First Place.

With home ownership requiring such a big financial and time commitment, you will want to be certain you are buying a house for the right reasons and that you understand the requirements to buy a house. I’ve compiled a list of some of the top reasons to buy a house. The more you can check off the list, the more likely you are to end up happy with your home purchase.

Top Reasons to Buy a House.

- Financial stability and long-term investment: Buying a house can be a good financial decision as it can increase in value over time and provide a stable source of income through renting or reselling.

- Sense of ownership and control: Owning a home gives you the freedom to make changes and personalize the space to your liking.

- Building equity: Every mortgage payment you make goes towards building equity in your home, which can be used as collateral for loans or a down payment on a larger property in the future.

- Tax benefits: Mortgage interest and property taxes are tax-deductible, which can result in significant savings on your annual tax bill.

- Sense of community: Buying a house in a neighborhood can give you a sense of community and connection to the people around you.

- Privacy and space: Owning a house can give you more privacy and space than renting an apartment, which can be especially beneficial for families with children.

- Potential rental income: If you purchase a property with multiple units, you can generate rental income and offset the cost of your mortgage.

Are You Prepared to Buy a House?

If you have determined that you are buying a house for the right reasons, then it’s time to seek out the guidance of a financial planner to help with the next phase. Why should you talk to a financial advisor before buying a house? Purchasing a home is probably the single greatest financial decision you will ever make. So naturally as a Certified Financial Planning Professional®, sworn Fiduciary, and home owner myself, I would strongly advise you to NOT go at it alone. Especially in today’s market. A financial planner will be able to take you through that process to best align what you desire, with your goals, while providing an unbiased opinion along the way.

A financial planner will help you with any questions regarding what should I do financially before buying a house or how do you manage finances when buying a house. Trust us, there’s a lot to do.

Finances: The first and most important factor to consider when determining whether you should buy a home or not is your finances. Buying a home is a significant financial investment, and you need to make sure that you can afford it. You should consider your income, expenses, and debt when determining whether you can afford a home. You should also consider your credit score and any outstanding debts that you may have. If you have a low credit score or a lot of outstanding debt, it may be difficult to get approved for a mortgage.

Location: Another important factor to consider when determining whether you should buy a home or not is the location. The location of a home can have a significant impact on its value, and it can also affect your quality of life. You should consider factors such as the crime rate, the quality of schools, and the proximity to amenities such as shopping, dining, and entertainment. You should also consider whether the location is close to your work or your children’s school.

Home Condition: The condition of the home is another important factor to consider when determining whether you should buy a home or not. You should inspect the home thoroughly before you make an offer. You should look for any signs of damage or wear and tear, such as leaks, mold, or termites. You should also consider whether the home is in need of repairs or renovations. If the home is in poor condition, it may be more expensive to repair or renovate than it would be to purchase a different home.

Timing: The timing of your home purchase is also an important factor to consider. You should consider the current market conditions and whether it’s a good time to buy. If the market is hot, prices may be higher, and it may be harder to find a good deal. If the market is slow, prices may be lower, and you may be able to negotiate a better deal. You should also consider your own personal timing, such as whether you’re ready to settle down and start a family or if you’re planning to move in the near future.

Emotions: Finally, you should consider your emotions when determining whether you should buy a home or not. Buying a home is a significant emotional investment, and you should make sure that you’re ready for the commitment. You should consider whether you’re ready to make a long-term commitment to a home and whether you’re prepared for the responsibilities that come with homeownership.

Buying a home is a big decision that requires a lot of thought and consideration. You should consider your finances, location, home condition, timing, and emotions when determining whether you should buy a home or not. By taking the time to consider these factors, you can make an informed decision that will be best for your financial and emotional well-being.

Top Reasons to Consider Waiting to Buy a House.

Saving for a down payment: One of the requirements to buy a house is having a rather significant amount of money for the down payment, so it’s important to have enough saved before deciding to make a purchase. How much? 20% is what you should be shooting for.

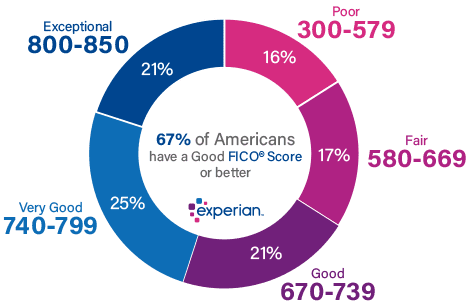

Good credit score: Another one of the requirements to buy a house is having a good credit score. It will help you qualify for better mortgage rates and terms, so it’s important to work on improving your credit score before buying a house. How high should it be? To receive prime lender status you will need to have a FICO score of 740+. You might be thinking, what is my credit score now, and with it, do I qualify to buy a house? To find out, get your free credit report at the only truly free credit report site mandated by the Federal Trade Commission, www.annualcreditreport.com. Once you have it, compare it to the ranges of the most commonly used FICO Score in the mortgage lending industry, the FICO Score 5. You should be shooting for a score of 740+ to get the best lending rates (interest rates). The better the interest rate the lower your monthly payments will be and the lower the total interest cost you will incur. While it is not required to have a credit score of 740+ to get a mortgage, anything less will cost you rather unnecessarily. Here is the breakdown. Exceptional is 800-850, Very Good is 740-799, Good is 670-739, Fair is 580-669 and poor is 300-579.

Job stability: It’s important to have job stability before buying a house, as lenders will want to see that you have a steady source of income to pay your mortgage. If you are in the military, move around a lot, or change jobs often, you might want to wait for some stability before you purchase a home or discuss with your financial planner how this might play out.

Waiting for the right market conditions: Timing the market correctly will be an important factor in determining whether it is better to buy than rent, however, it can be almost impossible to do reliably. Prices will fluctuate depending on the economy, the housing market, and the stock market, all of which we have no control over. It is also very difficult to determine what part of the cycle you are in. Have home prices peaked, or bottomed. Most likely the market is someplace in between. In that case, is the market on its way up or down?

Preparing for home maintenance costs: Owning a home comes with ongoing maintenance and repair costs, so it’s important to have enough savings to cover these expenses. Do you have a well funded emergency fund? 3 – 6 months of non-discretionary expenses is highly recommended and should be one of the first things you do when getting finances in order to buy a house.

Finding the right location: Finding the right location and neighborhood can be a long process, and it’s important to take the time to find the perfect location that meets your needs both today and in the near future. Consider how long you plan to live there, and is it big enough to accommodate a growing household?

Being financially ready: Buying a house is a big financial commitment, so it’s important to have a solid financial plan in place to ensure that you can afford the mortgage payments and other costs associated with homeownership. It’s also important to understand your future goals to know whether you will still be able to meet them with the added expenses of a home.

Time: There are large upfront costs associated with a home purchase. You will need to overcome those costs in order for the decision to buy to be better than the decision to continue renting. How long? Depending on the specifics, plan to commit to 5-10 years at that one location. The longer the better.

Real Estate as an Investment

A financial advisor will be able to map out whether real estate is likely to achieve your investment goals. Long gone are the days of the recent past where real estate is seeing six figure growth in as little time as a couple years. Buying a home today is not the slam dunk it turned out to be back in the 2010’s or even as recently as the early 2020’s. We’ve all heard the stories of a friend, family member, or gossipy coworker and the small fortune they made buying their home. Was their fortune from pure brilliance or just dumb luck? I would argue it was probably luck. Asset bubbles are common throughout history. One non-scientific way of determining when an asset bubble occurred, is when those that got in early make a killing off of those that got in late, especially when it’s over a short period of time. This is for simplicity purposes and is not how real asset bubbles are defined. Investment grade assets should not be, the winner takes all. Yet that has become somewhat common in the Real Estate market. So I would generally advise against putting your home in the same mental investment class as say a well diversified investment portfolio.

In real estate, the property itself does not create anything (excluding rentals and commercial properties). It is not an economic force on its own, at least not in the same sense as an investment in stock where you are buying ownership in well run companies that create and sell viable products at a profit. And although my opinion remains that real estate (your home) should not be seen as an investment, this article is not about proving that, instead it is to remind you that regardless of your opinion, Real Estate doesn’t always produce a return and even when it does, that return has historically been lower than other asset classes.

If not for an investment then why should we purchase a home? Home ownership is not for everyone and should not be for everyone. It’s expensive, it prohibits mobility, it’s illiquid, and maintenance can take up a lot of your time and resources, all risks that I’ll discuss more in detail below. However, for those that check the boxes, homeownership does have clear benefits such as financial stability, sense of community and potential tax benefits. Before you make the decision to buy a home though you should also consider the risks of owning real estate.

Risks of Owning Real Estate

There are inherent risks in every decision we make. Some of those decisions are going to be bigger than others. With average home values in certain parts of the country approaching a million dollars, this is probably the biggest financial decision you have made to-date, and might just be the biggest financial decision of your life. Big decisions can come, and in this case do come, with inherent risks. Add some of these items to your criteria to buy a house:

Big costs: While it is true in most sales that the seller of the home pays the real estate agent fees for both agents, consider that, you too may one day be a seller. With fees ranging from 4%-6% of the value of the home, selling a home is an expensive proposition. For a 500,000 home, expect to pay about $25,000.

Time commitment: If we were to totally remove appreciation from the equation (meaning the house sold for what you purchase it for) it can take 5-7 years of payments just to recoup the fees to sell. If you end up buying towards the top of a market cycle, or the market drops out from under you, you can find yourself in a deep hole if you had to sell it quickly. Remember, housing prices don’t only go up.

Maintenance/Repairs: What was once the responsibility of your landlord, as new homeowners, you’re now responsible to pay for routine maintenance, special assessments, and replacing things when they break. We bought our first home in 2017 and, since then we have replaced the dishwasher, the refrigerator, and both the washer and dryer, not to mention the other work we’ve put into the house. Special assessments from homeowners associations can be levied on homeowners with little notice. That assessment can be in the high thousands of dollars, and they can provide very little notice before the money is due. If say a tree fell on your roof, you would need to do a timely repair, else, your insurance company may be unwilling to pay if they found additional damage from say a rainstorm before the roof was fixed. So you should absolutely make sure a well funded emergency fund is part of your criteria to buy a house .

Requires consistent income: if you are a dual income family, and need both your incomes to qualify for the home, what happens if one of you loses your job, or gets injured and cannot work? You have to continue to pay your mortgage regardless of your circumstances. When you were renting, it would be much easier to downsize to a smaller unit if you had to. Again a well funded emergency fund can provide months of flexibility, so it’s so important to make sure it’s part of your l criteria to buy a house.

Outgrowing your home: Most of my clients are in the early to mid point in their careers. This is the time to start preparing and thinking about buying a home. This is also the time when families tend to grow. Whether your significant other becomes a spouse, or a family of 2 become a family of 3 or 4, with kids. Consider the future needs of your household. My wife and I (in the wake of the pandemic) both work predominantly from home. We are also working on having a kid. However, at the time of purchase, we both worked in offices and did not have a kid on the horizon. While our house is a bit small now, it will become too small almost immediately with a kid. So thinking about kids and your work situation at least 5 years out, when thinking about a home, will help you avoid having to sell at an in-opprtune time making the decision to buy worse than a decision to rent.

Mobility: Are you a restless spirit, or a perpetual job hopper? If the thought of staying put in a job or location for any length of time is difficult for you, buying a home to live in is probably not the best path for you.

I know this blog has a lot of information and it can be difficult to determine whether now is the right time to purchase a home and even more difficult to do so on your own. Reach out to FlightPath Financial Planning and schedule a time to meet with one of our Certified Financial Planner Professionals® to discuss whether the benefits outweigh the risks in your situation. Regardless of your decision, we will be able to help you put together a plan that will have you getting finances in order to buy a house, so you can purchase your home when the right time comes.

Interested in learning more about what we do for our clients and how we can help you achieve your goals?

Book a free consultation to learn more.